are hearing aids tax deductible in 2020

The Hearing Loss Association of America HLAA is a tax-exempt charitable organization and is eligible to receive tax deductible contributions under the IRS Code 501c3. Number of gift of hearing recipients.

Are Over The Counter Hearing Aids On The Way Lsh

If you are filing your taxes in 2021 for YA 2020 then head on over to our new article on everything you should claim here.

. Medical students attended our training. Moreover the accommodation premises must be registered with the Commissioner of Tourism to be eligible for the relief. We will not represent you before the.

This article pertains to income tax filing for the year of assessment 2019. Our impact in 2020. Research involving more than 40000 US households showed a convincing correlation between the degree of hearing loss and the reduction of personal income.

If approved we will issue a determination letter that describes your tax-exempt status and your qualification to receive tax-deductible charitable contributions. The standard deduction for single or married people filing separately was 12400. Audit Support Guarantee.

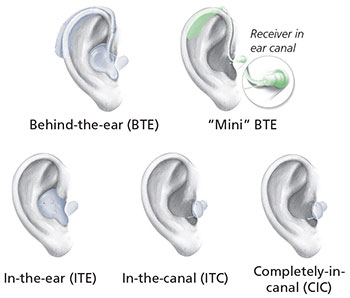

Today traditional Medicare doesnt cover hearing health but most Medicare Advantage programs include a hearing benefit as do some. In contrast hearing aids from a hearing professional can cost from 1500 a pair and higher depending on the technology features and the cost of services from the hearing care professional. Be a Healthy Hearing Ambassador and join the Ear Science team to find new audiology.

The payments must be made between 1 March 2020 and 31 December 2020 to qualify for tax relief in YA 2020. Mention of products or services on this website does not imply HLAA endorsement nor. This laws provisions are expected to go into effect in 2020.

This is a new tax relief introduced as part of the response to the Covid-19 pandemic. Use Form 1023 including the appropriate user fee to apply for recognition of exemption from federal income tax under section 501c3. Remember to check your insurance plan.

Calls to our Hearing and Tinnitus Help line. Hearing aid shop Dublin Ireland. Number of implant recipients.

The cost of hearing aids is a tax-deductible medical expense for those who itemize medical deductions. If you earn more than RM34000 a year youre not going to escape paying your taxes but what you can do is try to get them back in your tax refund. If you receive an audit letter based on your 2021 TurboTax return we will provide one-on-one question-and-answer support with a tax professional as requested through our Audit Support Center for audited returns filed with TurboTax for the current tax year 2021 and the past two tax years 2020 2019.

The determination letter will also show your. The standard deduction for married people filing jointly was 24800. Number of published peer reviewed articles.

Number of hearing aids donated. For the 2020 tax year.

Does Medicare Cover Hearing Aids Qrius

The 8 Best Invisible Hearing Aids In 2022 Updated For 2022 Aginginplace Org

Lively Hearing Aids Review Is Listen Lively Legit 2022

Are Hearing Aids Tax Deductible Sound Relief Hearing Center

Hearing Aids Lower The Chance Of Dementia Depression And Falling Hearing Loss Association Of America